Why Analysts See CLM as Mission-Critical in 2026

Shorter certificate lifespans, persistent outage risks from expired certificates, and the growing urgency of post-quantum cryptography PQC) have pushed certificate lifecycle management (CLM) into a new category with direct implications for availability, compliance, and long-term security strategy. What was once a background function is now a board-level concern.

This shift isn’t just anecdotal. Analysts are now evaluating CLM through a very different lens—one that reflects its expanding role in enterprise resilience and future readiness. And in 2026, that perspective matters more than ever.

Certificate lifecycle management has reached an inflection point

Today, enterprise CLM is increasingly judged by its ability to provide continuous visibility across diverse certificate estates, enforce governance at scale, and adapt as cryptographic standards evolve. Organizations are expected to manage public and private certificates consistently, across environments and use cases, without relying on manual intervention or fragmented tooling.

This shift reflects a broader change in expectations. CLM is becoming a measure of operational maturity and future readiness, not just technical hygiene. And that change in perspective is what’s driving analysts to look more closely at how vendors—and enterprises—approach certificate management in 2025.

What analysts now expect from enterprise CLM

As certificate lifecycle management has taken on a more strategic role, analysts have adjusted how they evaluate CLM platforms. Rather than focusing narrowly on issuance and renewal, analyst frameworks now emphasize whether CLM can support trust at enterprise scale—reliably and over time.

Across analyst research, several expectations consistently surface:

Continuous discovery and inventory: Enterprise CLM must provide comprehensive visibility across public and private certificates, environments, and use cases, establishing a reliable foundation for risk management and compliance.

Automation that scales with growth: Analysts look for automation that can handle large and expanding certificate estates across hybrid environments, enabling small teams to operate confidently without manual intervention.

Governance and policy enforcement: Modern CLM is expected to support strong access controls, audit trails, and policy enforcement, helping organizations meet regulatory requirements and respond effectively to compromise.

Future readiness and crypto-agility: As cryptographic standards evolve, analysts increasingly assess whether CLM platforms can adapt to support algorithm changes, migration planning, and long-term post-quantum readiness.

Why we believe IDC MarketScape is elevating CLM

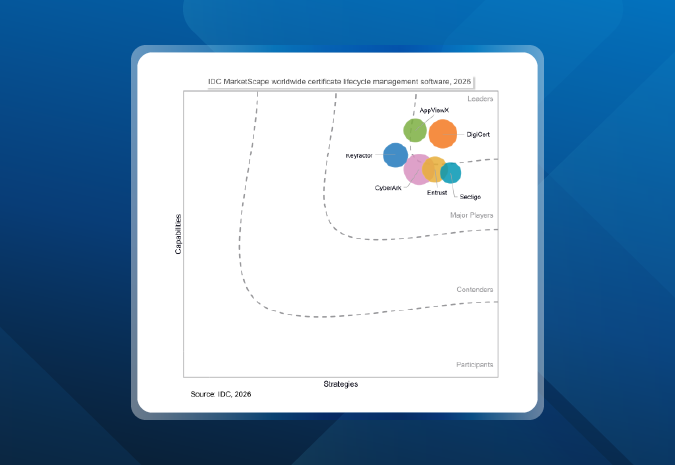

DigiCert believes the evolving expectations around certificate lifecycle management are reflected in how International Data Corporation (IDC) now evaluates the market. In the 2026 IDC MarketScape: Worldwide Certificate Lifecycle Management Software 2026 Vendor Assessment, we find that IDC treats CLM not as a supporting security function, but as a foundational capability for enterprise trust—one that directly affects availability, compliance, and long-term security posture.*

We feel that the IDC MarketScape’s analysis reflects a broader reality facing modern organizations. Certificate volumes continue to grow across infrastructure, applications, devices, and software supply chains, while lifecycles are becoming shorter and cryptographic change more frequent.

As a result, we believe the IDC MarketScape reflects a broader industry emphasis on several dimensions that go beyond basic certificate operations, including enterprise-wide visibility, automation at scale, governance and audit readiness, and preparedness for future cryptographic transitions. Together, these criteria signal a clear shift in how CLM is viewed—and why it’s become a strategic consideration for security and IT leaders planning for 2026 and beyond.

*Source: IDC MarketScape: Worldwide Certificate Lifecycle Management Vendor Assessment, Doc #US52990725, January 2026.

What we feel IDC MarketScape recognition means for security and IT leaders

In the 2026 IDC MarketScape for certificate lifecycle management, DigiCert is recognized as a Leader—recognition that we feel reflects IDC MarketScape’s assessment of DigiCert’s impact within the context of the CLM market.

For security and IT leaders, the IDC MarketScape recognition provides independent validation that a CLM platform can move beyond reactive certificate management. To us, it reinforces the importance of solutions that unify visibility, automation, and governance across certificate types while also preparing organizations for cryptographic change, including post-quantum transitions.

As environments grow more hybrid and regulated, analysts also increasingly emphasize the value of CLM platforms that can manage certificates across multiple certificate authorities and use cases, without introducing vendor lock-in. In an environment where trust failures can quickly become business disruptions, that combination matters.

Looking ahead: CLM as a foundation for enterprise trust

The way analysts now evaluate certificate lifecycle management reflects a broader shift in how organizations think about trust. Certificates underpin infrastructure, applications, devices, and software—and the systems that manage them increasingly determine whether trust can scale safely over time.

We believe the IDC MarketScape’s focus on visibility, automation, governance, and future readiness highlights an important reality for security and IT leaders: CLM decisions made today have long-term implications. As certificate lifecycles shorten and cryptographic change accelerates, the ability to manage trust consistently across environments becomes a strategic requirement, not a tactical one. With PQC moving from research into active planning, analysts are increasingly viewing crypto-agility within CLM as a prerequisite for long-term trust rather than a future enhancement.

For organizations planning their next phase of CLM maturity, independent analyst research can provide valuable perspective. The IDC Market: Worldwide Certificate Lifecycle Management 2026 Vendor Assessment offers a framework for understanding how vendors are positioned—and what capabilities matter most as enterprises prepare for 2026 and beyond.