Banking & Financial Services Security

Security That’s Right

on the Money

From customers to institutions, from transactions to data, digital trust is essential to protect the financial world.

Protecting Your Capital Investments in a Hyperconnected World

Today’s consumers expect more from online banking services, seeking convenience in tasks like opening accounts, making payments and transfers, and submitting loan applications. But the accessibility offered by digital banking also opens the door to heightened cybersecurity risks.

To stay competitive and secure, your bank has to provide delightful digital experiences without compromising customer data security—all while combating phishing attacks, preparing for quantum computing, and complying with GDPR, PCI DSS, KYC, and AML.

-

CHALLENGE #1

Preventing outages -

CHALLENGE #2

Modernizing PKI

Modernizing PKI

Financial companies depend on modern, scalable, and flexible PKI solutions to drive strong security practices and ensure regulatory compliance in a rapidly evolving digital landscape. Adopting a cohesive and adaptable PKI strategy is essential for financial companies to thrive in the dynamic digital era.

-

CHALLENGE #3

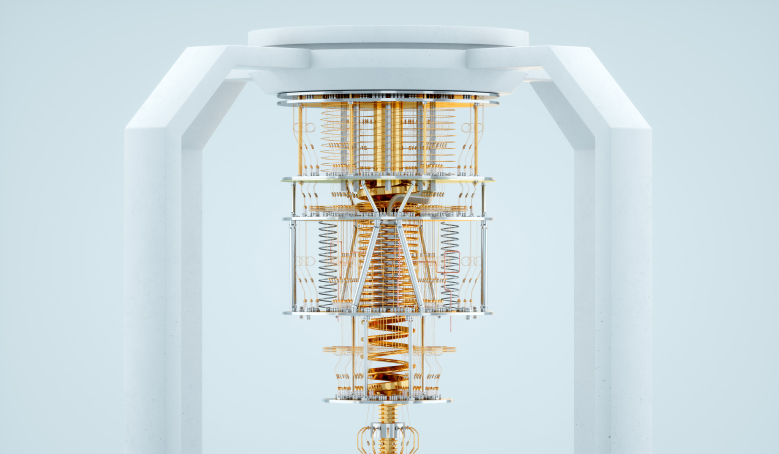

Preparing for a post-quantum future -

CHALLENGE #4

Managing software risks

Managing software risks

Every company relies on software, whether you're consuming or designing it. When vulnerabilities are exploited or malware is implanted, companies face financial losses and reputational damage.

-

CHALLENGE #5

Maintaining regulatory compliance

Maintaining regulatory compliance

Increasingly stringent regulatory requirements demand transparency and accountability in software development. And for good reason: Financial industry attacks are on the rise, and governments around the world are taking precautions to protect consumers.

Security Solutions That Are Right on the Money

-

Protecting consumers by protecting their data

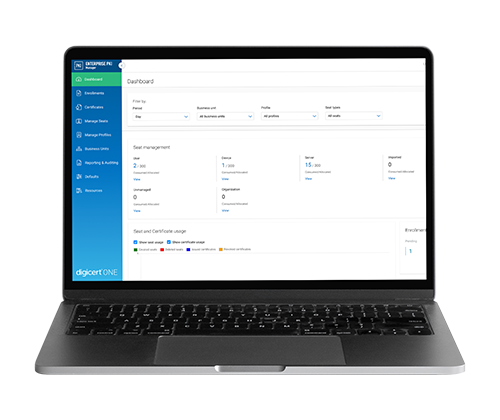

Reduce the risk of outages and breaches by centralizing visibility and control of your digital certificates. Certificate lifecycle management grants visibility into certificate inventory and enables automation for monitoring, inspecting, reissuing, revoking, renewing, and procuring new certificates across your environment.

-

Preventing outages and costly attacks

Reduce the risk of costly business disruptions and non-compliance that can occur as a result of legacy PKI systems. Modern tools like DigiCert® Trust Lifecycle Manager deliver visibility, automation, and integration across the PKI landscape to improve operational efficiency and identify vulnerabilities before an incident occurs.

-

Preparing for the future with crypto-agility

Every financial institution needs a robust plan for post-quantum cryptography to protect themselves and their customers from the vulnerabilities posed by quantum computers. DigiCert works closely with NIST and regulatory bodies to build policies for managing post-quantum cryptography. Begin now by making an inventory of your cryptographic assets.

-

Seeing and controlling software vulnerabilities

Minimize risks by implementing comprehensive software risk management strategies. Know what you publish and know it's safe. Using tools like DigiCert® Software Trust Manager, easily manage the security of third-party software, detect malware, and operationalize SBOMs for visibility into your software supply chain.

-

Operationalizing SBOMs for better transparency

DigiCert's Software Trust Manager can help ensure adherence to regulations, including new PCI requirements around software transparency through SBOMs. A centralized platform that robust policy controls, authentication and role separation, and comprehensive auditing and monitoring capabilities.

-

Meeting unique use case needs

The needs of the financial industry are unique. X9 PKI is a new standard for public and private PKI, designed to provide banks, merchants, ATMs, and other financial institutions with specialized security, interoperability, and control.

A Bullish Approach to Banking Security

From a financial advisor managing portfolios to a loan officer approving mortgages to an auditor ensuring regulatory compliance, DigiCert’s suite of security solutions secures every corner of the financial ecosystem.

Related Resources

Webinar

Introducing X9 PKI: A Managed Private PKI for Financial Services

April 2, 9:00 AM — 10:00 AM PST

eBook

Certificate Life Cycle Management: Trends to Watch in 2025

Report

Strengthening Finance Security through PKI Management and Software Safeguards

FS-ISAC Takeaways

5 Critical Actions for the Finance Sector in 2024

iSMG interview

How banking institutions can future-proof security

Blog

Quantum’s impact on the financial sector