-

Platform

Back

DigiCert ONE Integrations

-

Solutions

Back

-

Buy

Back

Signing Certificates

Everything you need to secure your site.

- Company

-

Resources

Back

-

Support

Back

Resources

Contact Support- Americas

- 1.866.893.6565 (Toll-Free U.S. and Canada)

- 1.801.770.1701 (Sales)

- 1.801.701.9601 (Spanish)

- 1.800.579.2848 (Enterprise only)

- 1.801.769.0749 (Enterprise only)

- Europe, Middle East Africa

- +44.203.788.7741

- Asia Pacific, Japan

- 61.3.9674.5500

- Americas

-

Language

- Contact us

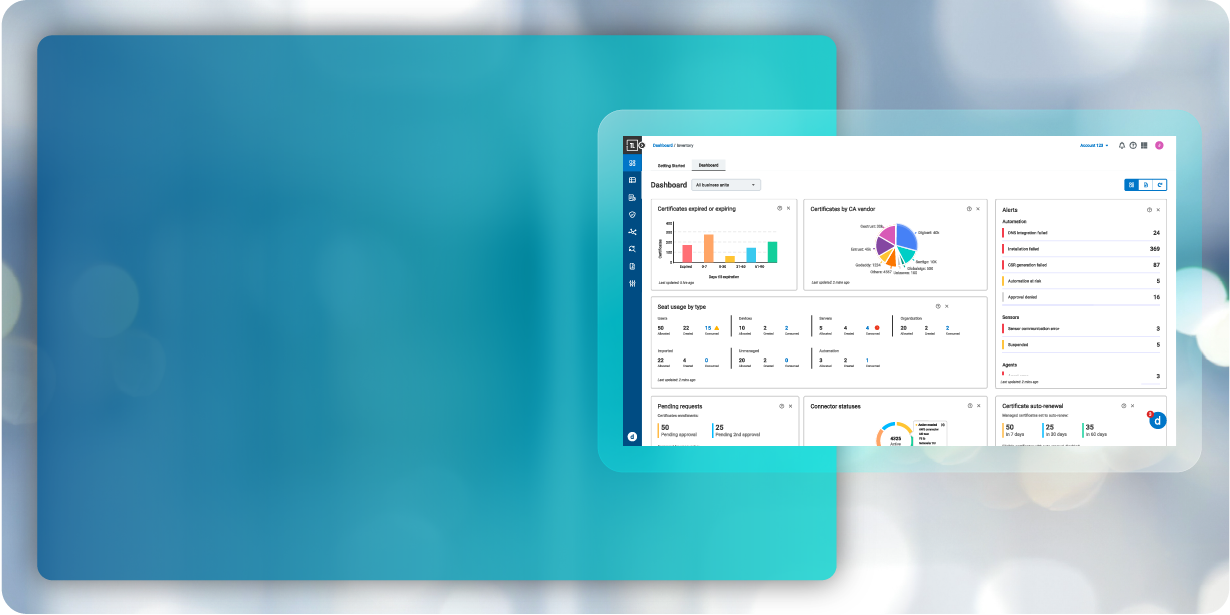

DIGICERT® TRUST LIFECYCLE MANAGER

Full Visibility,

Zero Certificate Disruptions

Strong security starts with strong PKI.

Gain control, stay compliant, and eliminate certificate disruptions.

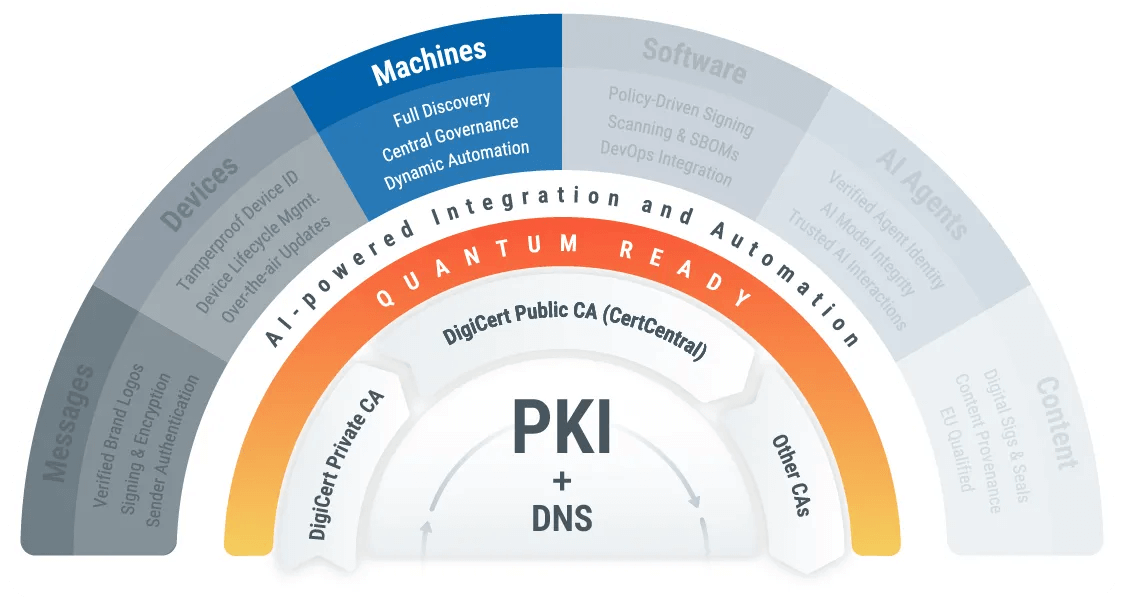

The DigiCert® ONE Platform

Gain visibility, eliminate outages and reduce costs with enterprise PKI and Certificate Management.

Optional heading that can be visually hidden

The Pressing Need for

Crypto-Agility

Traditional PKI lifecycle management tools lack automation, visibility, and flexibility, forcing IT teams to react to problems instead of preventing them.

The answer? A unified, automated PKI solution for full control over public and private certificates—no matter which authority they were issued by.

Use Cases

SERVERS & INFRASTRUCTURE

Secure, automated, CA-agnostic certificate management with agent/agentless support, multi-forest Active Directory compatibility, and network device integration to enhance security, achieve compliance, and prevent outages.

USERS & DEVICES

Enable secure user and device authentication with UEM integration, Zero Trust VPN/WiFi access, and smart card-based secure email for seamless, policy-driven security enforcement.

CLOUD WORKLOADS

Ensure secure container communications across hybrid and multi-cloud environments with secret management vaults and Infrastructure-as-Code (IaC) integrations for seamless certificate management and workload protection.

PRIVATE (INTERNAL) PKI

Simplify PKI with a scalable, cloud-based managed PKI that enables seamless integration, quantum-ready security, centralized governance, and reduced operational costs—no specialized expertise required.

Years of PKI Excellence

For 25 years, DigiCert has led PKI innovation, providing scalable, trusted certificate management solutions for enterprises, governments, and critical infrastructure.

Key Signings Per Year

DigiCert performs 3100+ key signings annually, ensuring secure, trusted PKI operations for enterprises, governments, and global organizations across diverse industries.

Public & Private Roots

DigiCert maintains 2600+ global private and public roots, enabling secure, scalable PKI for enterprises, governments, and global organizations across diverse industries.

Alleviate Certificate Management Challenges

Stop outages and take control of your certificate management

Optional heading that can be visually hidden

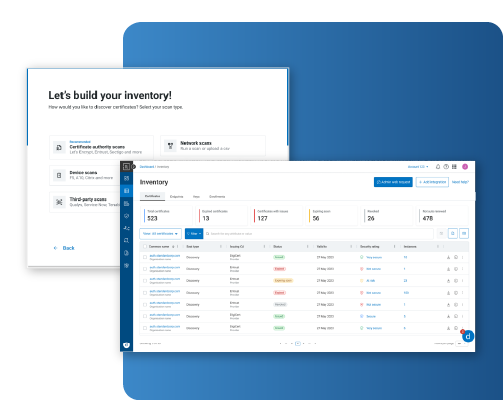

Simplified, Automated and Secure Certificate Management

Gain complete visibility and control over certificates across hybrid environments, automate lifecycle processes to prevent outages, and enforce compliance with industry regulations—seamlessly integrating PKI into DevOps workflows for scalable, secure deployments.

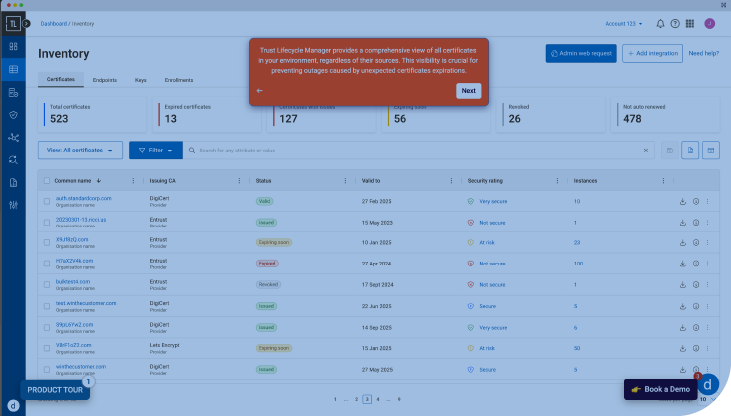

Know your PKI with Full Discovery

Discover and build a full certificate inventory using multiple techniques.

- Certificate Authority Agnostic

Import from any CA/PKI system including public and private. - Networks and Cloud Visibility

Scan the entire network and cloud for everything PKI. - Structuring the Unstructured

Get auto tagging.

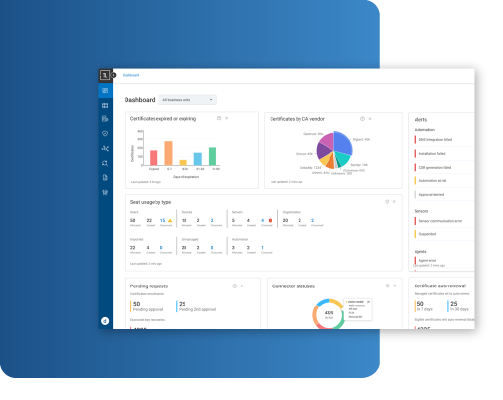

Mitigate Risks With Central Governance

Enforce Enterprise PKI Policies while Enabling Decentralized Operations

- Enforce PKI Policies

Eliminate weak keys, deprecated algorithms, and unauthorized CAs - Simplify Audits and Compliance

Meet PKI compliance controls, reduce cost, and time of audits - Decentralize Operations

Enable self-service and role-based admin with centralized governance.

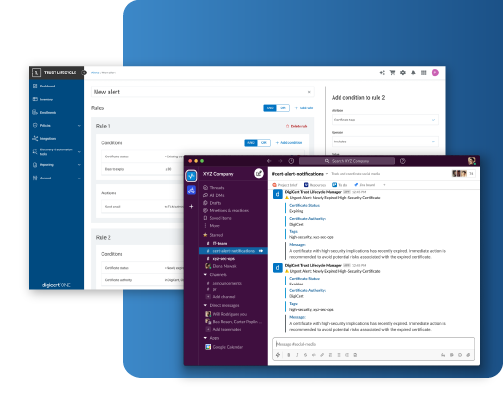

Prevent Outages With Timely Alerts

Know Asset Owners and Proactively Notify them of Expiring Certificates

- Assigned Asset Owners

Never miss a certificate renewal that impacts a critical service - Dynamic Rule Engine

Prioritize alerts based on business impact, e.g. expiration and criticality - Flexible Alert Mechanisms

Alert the right person on the right channel, e.g. email, text, Slack

Drive Resilience With Dynamic Automation

Prevent Critical Service Outages Caused by PKI and reduce staff costs.

- Seamless Integrations

Extensive agent and agentless options for enterprise systems

Go to Integrations Directory >> - Protocols and API Support

Seamless support for ACME, EST, SCEP and CMPv2 architecture - Self-Service Portal

On-demand certificate issuance, renewal, and management

Business Outcomes

Mitigate Risks

Ensure consistency and compliance across your certificate landscape with centralized governance.

Reduce Costs

Automate renewals so you can rest easy knowing you’re always protected from costly outages.

Prevent Outages

Get alerts about certificate validity mandates, sudden revocations, and distrust scenarios.

Meet Compliance Mandates

Streamline PKI management to prevent compliance failures, security threats, and downtime. Achieve full visibility into your PKI environment, ensuring regulatory adherence and uninterrupted operations.

Optional heading that can be visually hidden

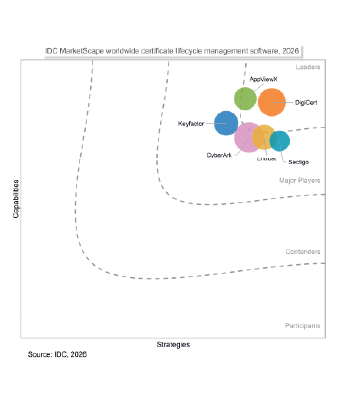

DigiCert Named a Leader in the 2026 IDC MarketScape

for CLM

Read the IDC MarketScape excerpt to see DigiCert's complete evaluation and understand why we were recognized as a Leader for Certificate Lifecycle Management.

Major Entertainment Company Secures PKI Following Breach

After a $100M+ cyberattack, a major entertainment company turned to DigiCert for rapid certificate automation, eliminating rogue CAs and protecting 500K+ machines against outages and future threats.

Optional heading that can be visually hidden

“Few vendors stand up & shine when it matters. DigiCert showed true Customer Obsession and flew in the same day."

-Vice President, Cyber Defense

Related Resources

CASE STUDY

Zscaler’s journey to faster, more secure certificate management

WHITE PAPER

Modernize Your PKI for Security,

Efficiency and Agility

EBOOK

PQC for Dummies

EBOOK

TLM Use Case eBook

Talk to an Expert or Schedule a

Trust Lifecycle Manager Demo Today

-

Company

-

My Account

-

Resources

-

Sites

-

© 2026 DigiCert, Inc. All rights reserved.

Legal Repository Audits & Certifications Terms of Use Privacy Center Accessibility Cookie Settings